Are Cryptocurrency Investments Right for You?

This is a guest article for subscribers and clients of JJJ Investing Services from an innovative leader in the world of international finance. Do you have a notable position and unique perspective in the investing or financial world? Contact us to inquire if you can be featured in a future article.

By Gavan Smythe, founder of iCompareFX

Expert opinion on the future of cryptocurrencies still remains divided. However, scores of people, including professional investors, have made considerable money by investing in cryptocurrencies. While there is an element of risk when investing in cryptocurrencies, the same also holds true for most other types of investments.

The Road So Far

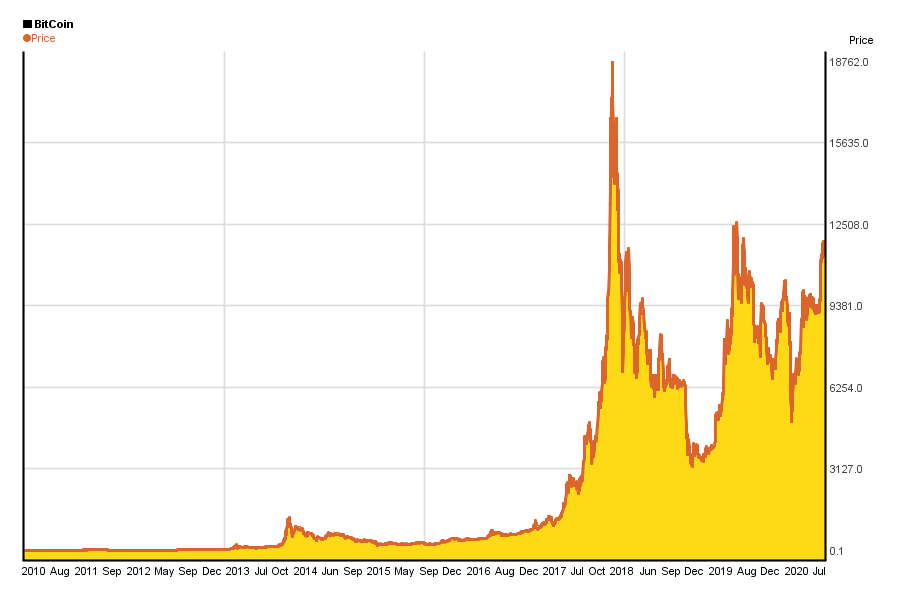

After witnessing a great run in 2017, the value of bitcoin plunged by around 65% in the January 2018. The value of other cryptocurrencies dropped as well. In the first quarter of the same year, the market capitalization of cryptocurrencies experienced a loss of at least $342 billion. By the end of November, bitcoin’s value dropped by more than 80% from its peak.

The value of bitcoin has experienced a revival of sorts in recent times. In February 2019, it traded at below $3,500. Its value breached the $5,000 mark in April, crossed $8,000 in May, and touched $13,000 toward the end of June.

What Does the Future Hold?

There are more than 2,000 listed cryptocurrencies, although over 800 are already out of circulation. Besides, not many make for suitable investment alternatives. For instance, there have been cases where people have all but lost their investments through well marketed initial coin offerings (ICOs).

The overall future of cryptocurrencies looks promising. Jack Dorsey, the CEO of Twitter, has started work on integrating multiple cryptocurrencies in his payments business, Square. What also helps is the entry of institutional money into this realm.

The New York State Department of Financial Services recently approved two U.S. dollar-backed cryptocurrencies – the Gemini Dollar (GUSD) and the Paxos Standard (PAX). There is talk of some leading cryptocurrencies making it to the NASDAQ. This would only help add more credibility. Several banks, financial institutions, and tech companies are also looking at how they can benefit by incorporating cryptocurrencies in their operations.

Watch Out for Scams

Investing in cryptocurrencies may yield great dividends, but exercising due diligence is vital. While there has been a significant decrease in cryptocurrency scams owing to government crackdowns, they keep popping up every once in a while. The case of AriseBank serves as a great example of how even the presence of seemingly big names serves as no guaranty.

If you plan to invest in an ICO, take time to delve into the details of the project. Determine if the board carries the required experience and whether the company knows enough about blockchain. Do not get swayed by celebrity endorsements.

How Much Should You Invest?

The last thing you want to do is invest all your money in cryptocurrencies. Remember that these investments come with their share of risks, so invest only how much you can afford to lose. Ideally, look at cryptocurrency investments from the long-term perspective, especially if the market is experiencing a slump. Incidentally, investing when the market is low can lead to greater returns when it gains traction again.

Diversify

There is no dearth of cryptocurrencies that you may invest in, but not all are equally reliable. Some of the ones that deserve your attention include:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Cardano (ADA)

- Dash (DASH)

- EOS (EOS)

- Ethereum (ETH)

- Litecoin (LTC)

- Monero (XMR)

- NEO (NEO)

- Ripple (XRP)

- Tether (USDT)

- Zcash (ZEC)

Conclusion

If you are looking at cryptocurrencies as a form of investment, you are not far off the mark. What you need to do is determine how much you wish to invest, and then think about diversifying. While you might be tempted to test uncharted waters by investing in seemingly lucrative ICOs, it is best that you stick to the tried-and-tested.

About the Author

Gavan Smythe is the founder of iCompareFX. This website lets you lets you compare the world’s best international money transfer companies across offered services and features. When he’s not working, Gav enjoys spending time with his family.

[…] one you should approach thoroughly and honestly before jumping into the market. Deciding if trading is right for you will take some thought, as there’s a lot to consider even beyond the questions listed […]

Do you have a Spreadsheet, App, Or Software to use for AIM Investing?

Hi Michael. Thanks for your question. Yes, Jeff Weber has created a spreadsheet that he uses to track and calculate AIM trades for every situation. It is still a mixture of art and science. Have you read his latest book “AIM for Millions with Stock Options” ? You’ll find the spreadsheet in there with step-by-step instructions. If you would like a one-on-one training session with Jeff that is an option but the book is a lot more affordable (and has more lessons from his 30+ years of investing with AIM). Thanks, Brett

Here is an excellent article on crytocurrencies – gives you lots of valuable information. Looking at the Bitcoin chart you see some amazing up and down swings. Well guess what is a great way to determine buy and sell signals on volatile investments? That’s right AIM investing method – works on LEAPS – will work on crytocurrencies too!

What would have made this article worth reading would have been:

1) How to invest in crypto

2) How to keep your investment safe

3) How to trade crypto within an IRA

Or some links to find that information

Thanks for your input and recommendations Jan. Those are also great topics. I hope you got something valuable out of this article still. If and when we find good resources or contributors to help you with those items we will use our blog to share it with you. — Brett