Union Pacific: Is There Any Hope?

Summary

UNP shares have continued their slide on the stock market this year as its entire business, except the automotive segment, is under pressure.

UNP’s performance in the coal segment will weaken further as production and supply of the fossil fuel is declining as coal plants are being retired.

Even in the intermodal segment, UNP is facing competitive pressures from rivals such as CSX, which is another negative for the company as it shows its inefficient execution.

Though UNP is trying to overcome the challenges by reducing costs and improving efficiency, the company has been unable to control the cash burn, raising a red flag.

Around six months ago, I had advised investors to expect more downside in Union Pacific (NYSE:UNP) shares on the back of weakness in crude oil and coal shipments. Since my article, Union Pacific has continued to slide and has lost over 15% of its value, and I believe that the downturn is not over yet. In this article, we will take a look at the reasons why Union Pacific shares are set for more downside going forward.

The problems

With 15% of overall revenue, coal is a key contributor to Union Pacific’s financial performance. However, this is Union Pacific’s hardest hit segment as the following chart shows.

Source: Investor relations

As seen above, Union Pacific’s coal volumes were down 22%, which led to a drop of 16% in the company’s freight revenue. Additionally, Union Pacific has also seen its intermodal segment take a big hit on the back of low oil prices that has encouraged shipping freight by road, while the decline in the industrial segment is surprising as industrial output in the U.S. is strong.

This means that even in a segment where there is growth, Union Pacific has failed to capitalize. This sets the tone for a weak year going forward as Union Pacific will continue facing weakness in key segments such as coal. This is because the continuous decline in natural gas pricing has encouraged most power plants to replace coal for cheaper natural gas and renewable energy sources for the production of electricity.

According to a report by the EIA, natural gas will enjoy a share of 32.3% in electricity generation this year, while coal will average around 33.3%. In comparison, in 2009, coal’s share was much higher at 45% and it was 39% in 2014. Looking ahead, the downtrend in coal consumption will continue as the EIA expects natural gas prices to remain lower than $3/MMBtu throughout 2016, which will encourage more power plants to use gas for electricity generation.

As a result, coal consumption in the U.S. is slated to drop this year, which will force companies to retire plants. In fact, until 2040, it is expected that 40 GW of coal-fired capacity in the U.S. will be retired, which is bad news for Union Pacific. As coal plants retire, production will be negatively impacted, so it is not surprising to see that coal production will fall nearly 6% to 834 MMst in 2016.

Moreover, it looks like CSX is losing its clout in the intermodal business as well. As we saw above, the company’s intermodal volumes last quarter were down 7%, while CSX was able to improve volumes in this segment by 4%. This indicates that Union Pacific is falling prey to its competitors in the intermodal segment, which is bad news for investors as intermodal is 20% of Union Pacific’s business in revenue terms.

Are operating improvements enough?

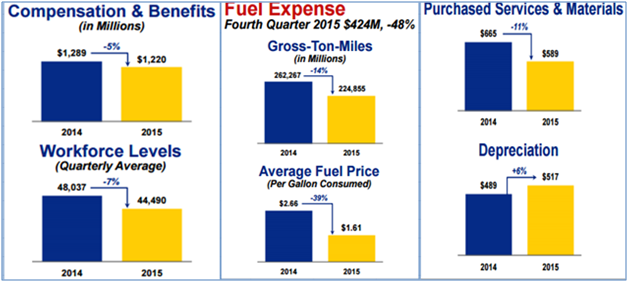

To make up for the decline that Union Pacific is witnessing in its key business segments, the company has been focusing aggressively on reducing costs. For instance, Union Pacific has aligned its workforce with end-market demand, which is why it reduced its workforce by 7% last year, leading to a drop of 5% in compensation and benefits.

Moreover, lower oil prices have turned out to be a tailwind for the company, as shown in the chart below. All in all, Union Pacific was able to lower its operating expenses by 13% last year, which is impressive.

Source: Union Pacific

Along with the decline in the cost base, Union Pacific has improved efficiency by taking steps such as reducing number of cars switched to the tune of 8%, which has led to a drop in the terminal dwell time by 5%. Additionally, Union Pacific has increased the train size across different segments, recording 2% increases in sectors such as automotive, coal, and grain.

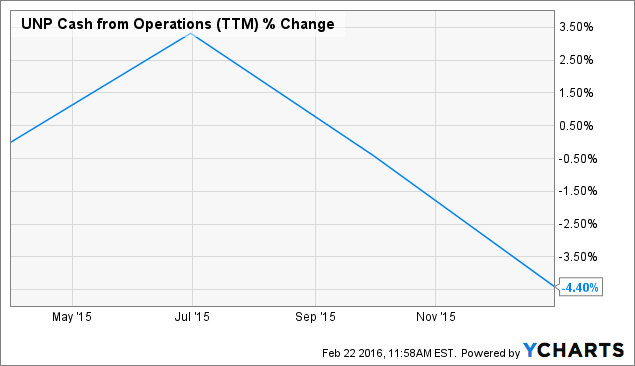

However, despite these cost-reduction moves, full-year operating ratio in 2015 declined by four percentage points as compared to 2014, indicating that the decline in the top line washed away the benefits of lower costs. Also, as seen in the chart below, despite all of its cost-cutting efforts, Union Pacific’s operating margin has started declining of late, while it has also started burning cash:

UNP Cash from Operations (NYSE:TTM) data by YCharts

Conclusion

Thus, it can be summarized that Union Pacific’s cost reduction moves have not been enough to make up for the decline in its volumes and revenue. As discussed above, Union Pacific will continue seeing weakness in its top line performance going forward due to challenging coal and intermodal segments, which will create more pressure on its operating margin and cash flow. So, in my opinion, investors should stay away from Union Pacific as it is primed for more downside.